Tax Services

Navigating the complexities of taxes demands a dedicated and experienced team.

Our exclusive focus is on you, guiding you through tax cycles and providing tailored business advice.

With our expertise, we handle diverse requests, whether selling assets for immediate revenue or managing inheritances without accruing excessive debt.

Regain financial control with our specialized tax services, the only investment-worthy accounting solution.

Specific Tax Services We Offer

Business & Corporate Tax

Company Tax Returns

Provisional Tax Returns (EMP 501's)

Dividends distribution and tax management

Tax Planning

Value Added Tax (VAT)

VAT Registrations

VAT Management, Administration and Computation

VAT Report Preparation

VAT Returns

SARS - South African Revenue Service

SARS Communication

SARS Registration

Tax Audits with SARS

Tax disputes/ dispute resolutions with SARS

Payroll Management

PAYE Registration

PAYE Returns & Submissions (EMP 201's)

IRP5’s Certificates

Unemployment Insurance Fund (UIF) Returns

Workman Compensation Registration and Annual Returns

Monthly Payroll Management

Monthly Employment Cost Report

Maintaining Employees Information Database

Business & Corporate Tax

Company Tax Returns

In South Africa, every company is required to pay taxes at a rate of 28% on all profits after deducting allowable expenses. This taxation framework is essential for ensuring financial accountability and contributing to the country's economic development.

Provisional Tax Returns (EMP 501's)

Companies in South Africa are required to pay provisional taxes twice a year, with deadlines falling in February and August.

These payments, known as provisional tax, ensure that companies meet their tax obligations throughout the year, contributing to the country's revenue streams and supporting essential public services and infrastructure.

Dividends Distribution & Tax Management

Managing dividends distribution involves navigating tax implications and administrative responsibilities.

Our professional team ensures accurate and compliant dividend declarations, relieving you of the burden and ensuring everything is handled correctly.

Tax Planning

Tax planning involves strategizing to minimize tax liabilities throughout the year, not just during tax return filing.

For businesses, effective tax planning can potentially reduce taxes to zero or a minimal amount.

Small businesses may overlook tax planning opportunities due to lack of awareness or expertise, but professional assistance can ensure they capitalize on available strategies.

By implementing tax planning strategies before year-end, businesses gain a competitive edge by minimizing tax burdens, ultimately enhancing their financial performance and viability.

Value Added Tax (VAT)

VAT Registrations

Value Added Tax (VAT) is levied on the value added to goods and services at each stage of production or distribution.

Businesses are required to register for VAT if their total sales exceed 1 million Rand within a 12-month period.

VAT Management, Administration and Computation

Effective VAT management, administration, and computation are essential for ensuring compliance and avoiding financial challenges.

VAT payments are typically due every two months, and it's crucial to set aside funds to cover these obligations.

We specialize in separating and managing your funds, ensuring accurate calculations and maintaining readiness to cover your VAT liability. This proactive approach safeguards your financial stability and prevents cash flow disruptions.

VAT Returns

We handle your VAT returns diligently, submitting them every two months to ensure compliance and prevent any issues with SARS.

Our meticulous approach guarantees accuracy and completeness, alleviating any concerns you may have regarding VAT obligations.

SARS - South African Revenue Service

SARS Communication

Communicating with SARS can indeed be frustrating and time-consuming.

Save your valuable time and let us handle all communication with SARS on your behalf.

With years of experience navigating their complex communication channels, we ensure efficient and effective interaction, freeing you to focus on your business priorities.

SARS Registration

When registering a company, it is assigned a tax number by SARS.

This tax number is essential for filing taxes and conducting tax-related transactions.

To streamline the process, we utilize this tax number to e-file your taxes, simplifying and expediting the tax filing process.

Tax Audits with SARS

Tax audits with SARS can occur if there are concerns about tax compliance or discrepancies in tax filings.

Our team will handle the audit process on your behalf, ensuring that everything is up-to-date and compliant with tax laws.

We'll work to protect your interests during the audit, safeguarding you from any attempts to take advantage of the situation.

With our expertise, we strive to ensure that the audit proceeds as smoothly as possible, minimizing any potential disruptions to your business operations.

Tax Disputes / Dispute Resolutions with SARS

Tax disputes with SARS can arise when there are disagreements regarding tax assessments or liabilities.

Our team is here to support you and will handle any disputes with SARS on your behalf.

Dealing with tax disputes can be stressful and time-consuming, so it's best to let us handle the process while you focus on other important matters.

With our extensive experience in this field, we will represent your interests effectively and work towards resolving the dispute in the most favorable manner possible.

Payroll Management

PAYE Registration

Every employer in South Africa is required to register for Pay-As-You-Earn (PAYE) taxes. PAYE is a system of tax withholding where employers deduct tax from their employees' salaries or wages and remit it to the South African Revenue Service (SARS) on their behalf. This registration ensures compliance with tax regulations and enables employers to fulfill their tax obligations correctly.

PAYE Returns & Submissions (EMP 201's)

Submitting PAYE returns (EMP 201's) is a monthly requirement for businesses in South Africa.

Handling this process manually can be time-consuming for business owners, but our automated systems have streamlined this task for numerous businesses.

Let us simplify this process for you as well, ensuring accurate and timely submission of your PAYE returns each month without the hassle.

IRP5’s Certificates (Annual Records Of Tax Paid)

IRP5 certificates are essential annual records that document the taxes you've paid throughout the year.

These certificates provide a comprehensive overview of your tax contributions and withholdings.

If you've overpaid taxes during the year, you may be eligible for a tax rebate, which can be claimed based on the information provided in your IRP5 certificates.

Unemployment Insurance Fund (UIF) Returns

All employers in South Africa are required to contribute to the Unemployment Insurance Fund (UIF) on behalf of their employees.

The UIF serves as a safety net for employees who lose their jobs, providing them with financial support while they search for new employment.

Ensuring regular contributions to the UIF is not only a legal requirement but also a vital aspect of supporting employees during times of unemployment.

Workman Compensation Registration and Annual Returns

It's essential for all employers to register with the Workmen's Compensation Fund in South Africa.

Registering with the Workmen's Compensation Fund not only ensures legal compliance for employers but also provides essential protection and support for employees in the event of workplace injuries or illnesses.

Additionally, employers must submit annual returns to the fund to maintain compliance and ensure continued coverage for their employees.

Monthly Payroll Management

Ensuring employees are paid accurately and on time is crucial for maintaining their satisfaction and overall productivity.

Our dedicated team specializes in monthly payroll management, handling all aspects of payroll processing efficiently and accurately.

By entrusting us with your payroll needs, you can rest assured that your employees will be paid promptly each month, allowing you to focus on other important aspects of your business.

Monthly Employment Cost Report

Managing employment costs is a significant aspect of business expenditure.

Understanding the value of staff salaries is crucial; determining whether they align with company goals and contribute to overall success.

Assessing employee performance is key; recognizing when to hire new talent or invest in upskilling current staff.

It's often overlooked that underperforming employees can lead to financial losses for the company.

Maintaining Employees Information Database

A comprehensive database of employee information is invaluable for effective workforce management.

We meticulously maintain a database containing all pertinent employee details, ensuring quick access to necessary information when needed.

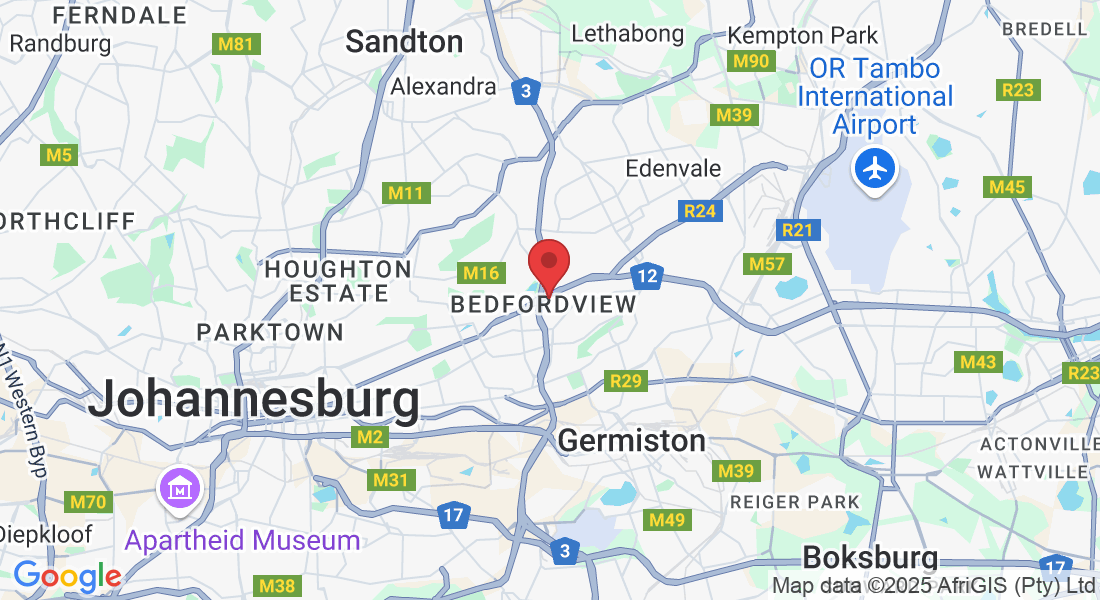

Business Address

Address:

AMR Office Park, 3 Concorde E Rd, Bedfordview, Johannesburg