Accounting Services

Having the most up-to-date information is crucial.

Regularly updating your records with accurate numbers ensures that your accounting reflects current details and avoids outdated assumptions. The frequency of updates depends on your company's needs, whether it's every few months or annually.

Neglecting to keep your accounting updated harms your business's future. You owe it to yourself, and the world benefits from avoiding the repercussions of business decisions made with inaccurate data, which could lead to debt or poverty.

Specific Accounting Services We Offer

Monthly Accounting

Management accounting and monthly reporting

Cash Flow Projections

Financial Statements

Invoicing System

Yearly Budgets

Reconcile accounts every month

Asset management including debtors, creditors, and inventory analysis

Monthly Accounting

We offer monthly accounting services to ensure your financials are always clear and accurate.

With your best interests in mind, we meticulously examine every aspect of your finances.

We provide detailed insights into your cash flow, informing you of the money coming in and going out of your business each month.

Management Accounting & Monthly Reporting

Are you struggling to track where your money is going and constantly experiencing losses?

The monthly reporting process can indeed be overwhelming for many businesses, leading to a significant gap in understanding profitability and potentially larger losses.

But what if accessing this crucial information was as simple as a few clicks?

With our management accounting and monthly reporting services, you'll never again be in the dark about your finances or grow complacent about budgeting tactics.

Success in running a company begins with ensuring your finances are on point. Follow us and experience the path to success!

Cash Flow Projections

Cash flow projections are essential for determining your immediate and future cash needs, as well as understanding what your CFO discussed last week.

Modern Accounting Software Cash Flow Projections feature automatically forecasts future cash flow and adjusts for changes in the balance sheet or external factors impacting revenue, such as economic fluctuations or supply chain disruptions.

This tool empowers planners and decision-makers to anticipate and mitigate risks stemming from external factors like natural disasters, geopolitical events, or trade conflicts.

Experienced entrepreneurs understand the importance of managing budgets and projecting timelines to avoid unexpected costs at every stage of the business lifecycle. With Cash Flow Projections, you can stay ahead of financial challenges and ensure the stability of your business.

Financial Statements

Financial statements can indeed appear complex, and understanding all the lines and columns may be challenging at times.

You might wonder about the significance of various elements on the balance sheet and why there are different colors.

However, despite the initial complexity, recording your financials is crucial for any successful business.

A well-organized set of financial statements provides valuable insights, indicating whether you should persist with your current strategy or consider adjustments.

Don't let the initial confusion deter you—mastering your financial statements is key to making informed decisions and driving your business forward.

Invoicing System

Our invoicing accounting system ensures that the invoicing module is consistently updated with the latest information regarding billed, paid, or unpaid transactions.

In the invoice detail section, you'll find comprehensive information about what was ordered, delivered, and billed for, ensuring clarity and accuracy.

Moreover, the system automatically tracks payments, providing insight into who paid and when each payment was made, streamlining the payment tracking process for efficient financial management.

Yearly Budgets

Yearly budgets provide clarity on how to allocate your hard-earned money efficiently.

Gathering and organizing data can be time-consuming and require expertise.

With a yearly budget, you can streamline the process, ensuring that funds are utilized optimally for both expansion and maintenance of your endeavors.

This product alleviates the concern of wasted money without the hassle of extensive manual work.

Thanks to our simplified approach, creating a yearly budget is now accessible and straightforward for anyone.

Reconcile Accounts Every Month

Reconciling accounts monthly is a proactive practice that eliminates the need for constant book verifications and audits, providing peace of mind.

Up-to-date records not only enhance investor, partner, and customer interest but also contribute to showcasing success stories effectively.

It's crucial to remember that accurate record-keeping is paramount. Any discrepancies can have significant consequences, whether legally or in everyday discussions.

Let us handle the heavy lifting with our seamlessly automated Reconciliation Services each month, ensuring accuracy and compliance without the hassle.

Asset Management

Centralize all your assets for streamlined management and protection.

Proper planning safeguards your assets while maximizing retirement savings through strategic asset distribution.

Accelerate debt repayment to enhance cash flow, unlocking financial freedom and security.

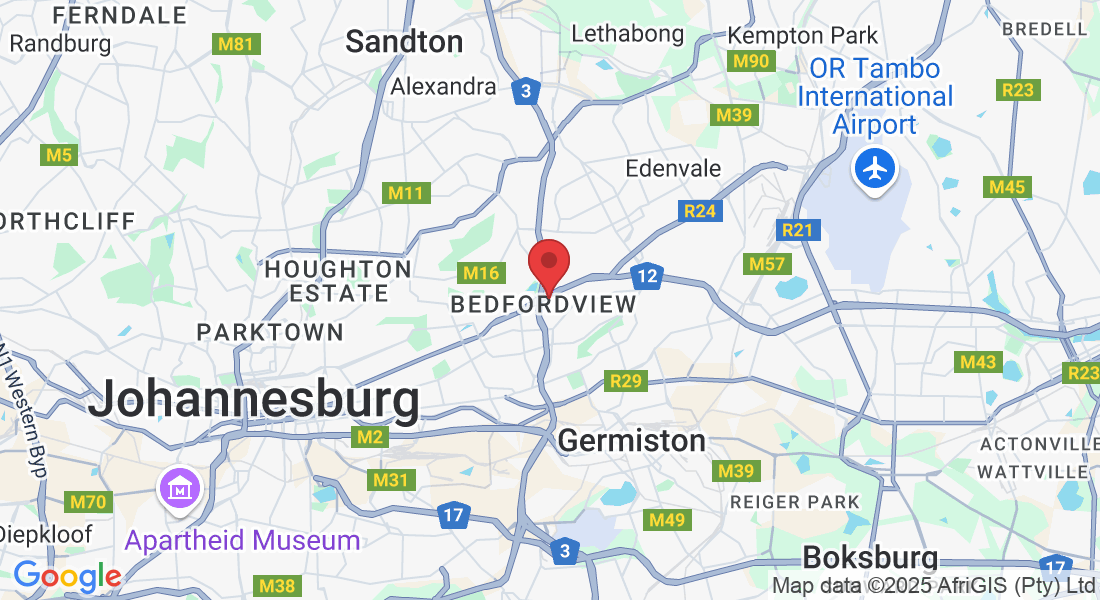

Business Address

Address:

AMR Office Park, 3 Concorde E Rd, Bedfordview, Johannesburg